The Most Popular DITA CMSes (Part 1)

Easily the most visited page on this website is the DITA CMSes page, listing all of the DITA-capable CMSes I have been able to track down. It typically gets several hundred visits per month—closely followed by the list of DITA Optimized Editors and the DITA-related Software Tools pages—telling me that there’s a strong need out there for good information on DITA CMSes. The DITA CMS list is currently undergoing a revamp and will be updated shortly, but up until now there has been no indication as to which of these DITA-capable CMSes are in wide use, and which are not.

So as a side-project I have started tracking which CMSes (if any) were mentioned by people on LinkedIn, SlideShare and other sources, and then comparing that the list of Companies Using DITA. I also cross-checked lists of company clients that are claimed by various CMS vendors and looked for confirmation that those firms were using them in a DITA context, since many DITA CMSes are capable of handling other XML formats, like DocBook or S1000D. I have managed to track down the CMS usage of just over half of the firms that are known to be using DITA, and what emerges tells the tale as to which DITA CMSes are actually being used and where.

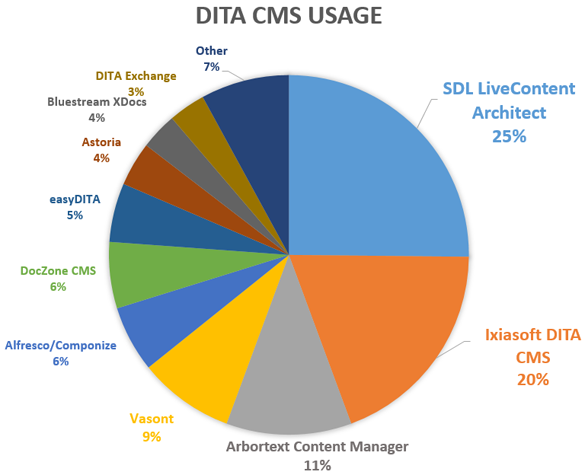

So what is the most-used DITA CMS? SDL LiveContent Architect (formerly known as SDL Trisoft), is used by fully a quarter of all firms that I could identify that are using a DITA-capable CMS. This is closely followed by Ixiasoft’s DITA CMS, which has 20% of that market. These two firms hold the lion’s share of DITA CMS deployments that I could track down. After that comes a mix of other players, including long-standing CMS firms like Vasont and Arbortext, and a lot of what I would call “up-and-comers” who are those firms that have only recently come onto the market. Here’s what this looks like:

So is this a complete picture? No. But I think it does show some real trends. Understanding the full picture means delving into some history…

The “Big Two”

Both SDL and Ixiasoft’s products have been on the market a long time, and have clearly proven successful.

SDL’s current product offering is the result of a buy-outs and mergers of previous CMS firms, most notably Idiom and Trisoft. In the localization industry SDL is better known as a major vendor of translation tools and software, so it is a reasonable expectation by customers that SDL LiveContent Architect can handle this easily. This is pure speculation on my part, but am guessing that many of SDL’s DITA CMS customers were already using their localization services, so it already had a “foot in the door” sales-wise and made for easier penetration into this marketplace. Much to SDL’s credit they have been able to improve upon the solid codebase they acquired and integrate it into their other tools, providing a software suite that is clearly compelling to many customers.

Ixiasoft has also been on the market for a long time, and was one of the first major CMS systems specifically aimed at the DITA market. Arguably their strength has been their core XML-based repository (TEXTML) which is ideal for handling DITA content, which could handle files and file operations much more quickly than the standard databases used by many other CMS products. While this advantage has diminished thanks to the faster processing speeds available today, the ability to work natively in XML also makes it easier for clients to directly manipulate content with other third-party tools. Speaking from personal experience as a former client and as a consultant, I know that Ixiasoft has always worked with their customer base extensively, with subsequent customers benefiting from features originally designed for earlier clients.

Both firms have been able to capitalize on the early advantages that they had and now appear to dominate much of the DITA CMS marketplace.

Not Just DITA

Another core grouping I see here are those firms that do not exclusively concentrate on DITA, but also other XML standards like DocBook, SGML and S1000D. These include the #3 and #4 firms (Arbortext Content Manager and Vasont) and other players like Astoria and SiberSafe (which is in the “Other” group—more on that later). While they do not appear to dominate the marketplace as SDL and Ixiasoft do, each firm had the distinct advantage of being able to work with previous XML standards, making the transition process for some customers from legacy content to DITA easier. As with SDL, some of these firms likely had a foot-in-the-door already, either through things like Arbortext’s XML editor software, or previous CMS installations for non-DITA content.

So why are they further back in the pack? I suspect it has to do with an initial lack of focus on the needs of the DITA market. From the start both SDL and Ixiasoft focused squarely on DITA, whereas these other players have been initially designed for use with other XML specifications. “DITA-capable” is not the same as “DITA optimized” and the advent of the complex features introduced with the DITA 1.2 specification required significant development efforts that in some cases have only been realized recently. Having said that these vendors definitely understand the strength of the DITA CMS space and have made up for lost time with what are now genuinely solid products.

The “Up-and-Comers” and the “Others”

There is another distinct group I see here who are further back in the pack than the market leaders, which I think is due more to the relative new-ness of their product offerings, and are consequently are still likely growing their share of the DITA CMS marketplace. This includes firms like easyDITA and DITAToo (which is a member of the “Other” category). Both of these products are relatively recent entrants into the DITA CMS space; both easyDITA and DITAToo came on the scene in 2011. Their relative newness hints that these firms have not yet fully established themselves in the DITA CMS marketplace and that we see here is only the beginning of their potential.

The “Other” category consists of those firms for whom I could only find three or fewer DITA-specific clients. This includes:

- Cinnamon

- DITAToo

- RSuite

- Schema ST4

- SiberSafe

- TeamCenter

- x:Point

Some of these firms do not concentrate exclusively on DITA (like RSuite and SiberSafe) so while they definitely have a larger overall customer base, determining which of these customers were DITA-specific was hard. Others are fairly new to the market, and x:Point is an add-on to SharePoint installations to better facilitate DITA usage, so it fills a particular niche.

This is also where I suspect there is significant under-reporting of DITA CMS tool usage. As I will show in the next article many of the DITA CMSes in the other categories have strong representation within large firms, whereas the aim of many of these products is at smaller companies and organizations. As a result they are the most likely to be under-represented in a survey like this; it is easier to find someone who will talk publicly about a DITA CMS used at a firm with 5,000 or more employees, less so for firms of a hundred people or smaller, so there is a self-selection bias likely happening with both the “up-and-comers” and with the “others”.

Next article: DITA CMS market segmentation

Great research, Keith! Very interesting analysis.

Thanks Seraphim!

Keith,

As usual, you’ve brought some very interesting insight to the community. Thanks!

I’m not faulting your research methods (hey, mining public data is a great approach, and I appreciate your under-reporting proviso), but I’m wondering how we might be able to pull some more correlating data to the front. Such as the number of assets under management by various systems. How many documents are published per day be each platform, etc.?

In particular, the “big two” you’ve identified couldn’t be more different under the hood … one being a Windows/Oracle based platform and the other being a host OS independent XML-navite platform. That should make a huge difference in how productive content creators / curators / publishers are with the two platforms, particularly when deployed for the more complex content models of DITA and S1000D.

Great food for thought!

Bob

Hey there Bob:

You make some good points. Unfortunately the only way to pull correlating data out on such things as publication volume would be to get that information directly from those firms, as there is sadly (from my perspective at any rate) no way to automatically distinguish DITA-based PDF/HTML output from that produced by other means.

I think the answer to your other point will come in the next article, which will look at which types of firms are investing in these DITA CMSes (hint: they’re not small companies).

Keith,

Sadly, you’re right about the dearth of readily available data to help automate gathering such data. One could conceivably scan the DC and/or XMP and/or PDF metadata of files posted on companies’ web sites, but without some sort of standardization of that data across many industries, I fear the data collected would be so inconsistent that no correlation to a DITA origin could be drawn. For example, you could look for PDFs where xml:CreatorTool or pdf:Producer identify AH Formatter or XEP and be reasonably sure that the publishing pipeline is XML based. But there’s no way to know that the XML source material was DITA.

Ironic that no origin of species can be inferred in Darwin-ITA progeny, no?

Very interesting and helpful post. I’m not sure how it relates to popularity, but it would be nice to include some ballpark cost figures here. Presumably this post would be helpful for someone trying to find the right CMS. Knowing that Ixiasoft costs $160k etc might be an interesting detail to correlate with popularity. Even if you used dollar signs similar to restaurant rankings ($ and $$ and $$$ and $$$$) it would provide more context to better understand the available options. Even so, this is still a great list.

I echo Tom’s thought here, and would suggest two “cost rank” columns: one for purchase/license cost and one for configuration/support cost. Perhaps over a 5-year time span so that in-house vs SaaS products can be compared.

Ooops … we’re asking you to do a LOT of work there Keith … work for which consultants are normally paid quite well!

If CMSes were like other software I’d happily add pricing info — but of course it is not as simple as that.

I like Tom’s idea of using dollar signs akin to restaurant rankings, but I don’t believe *any* of the CMS vendors post their pricing information online, and that’s usually because of several factors:

– cost often differs depending on the number of licensed users

– there’s often one price for the CMS, another for the database/repository

– price may be negotiable depending on the length of related contract services (i.e. legacy transfer, support contract, etc.)

– sometimes there is no fixed price per se, but instead depends on “the size of the company”

Having said that I am all for transparency when it comes to this sort of thing, and would urge the CMS vendors to be more forthcoming with this sort of information.

Cost and Popularity are two variables that frequently change and are often left to biased opinions. Therefore it should never drive your decision to purchase any tool. It should be based on your company’s business needs.

This article organizes and demonstrate the players in the field and who you can investigate further for DITA CMS, if you happen to be in the market.

easyDITA has pricing: http://easydita.com/pricing/

I thought Bluestream XDocs did at one point, but I can’t find it.

Many thanks for the research!

I had no idea you were working on this! Great job on ferreting out who the players are like an investigative journalist. I am thrilled to see Arbortext represented here. At Single-Sourcing Solutions, we have a wealth of Arbortext expertise. (In fact, we do free trainings every month in our TC Dojo – Arbortext Edition.) And yet, so often I find I have to defend Arbortext to others who won’t even mention it because they aren’t sponsored by PTC. Kudos to you for your neutral approach!

Many of these players have been around (in some form) before the days of DITA – Arbortext, SDL, Vasont, Ixiasoft, Astora. They all cut their CMS teeth on other doc structures long before DITA and many are an evolution of some former software. But why is one more popular than the other? Good question! No two players are the same and the end pricing has so many additional variables that by the end of it cost is similar for same-size implementations.

Popularity also has a lot to do with differences in implementation and corporate focus. In PTC’s case, their focus is on PLM – not ACM for tech pubs – so having such a high ranking looking at things from a purely technical publications position is really a side bonus for them, as a company. I hope to see Arbortext growing in market share: ACM has all the bells and whistles you could ever want. Arbortext as a whole, is an excellent tool suite that works well together as an end-to-end solution regardless of your data structure.

Keith,

Why doesn’t Ixiasoft publish product costs on its website? My experience is that if it takes a sales discussion to determine cost, then you better be prepared for a SAAS and/or license-per-seat solution. In the DITA world, license-per-seat somewhat defeats reuse/cross department use model due to cost. I am not familiar with Ixiasoft, but I have much experience with SDL. SDL is popular indeed, but only for enterprise customers, not small-to-medium-sized-businesses (SMBs). SDL is overkill and cost prohibitive for SMBs (maybe not for some medium sized businesses depending on size and revenue). Is this also true of Ixiasoft? If you limited the qualification to SMB, I’m pretty sure your pie would have a very different popularity makeup.

I can’t comment on why Ixiasoft doesn’t publish it’s prices online, but this is fairly common practice for CCMSes aimed at medium- to large-businesses. This type of software is not your typical off-the-shelf software, but instead requires a deeper level of engagement with the customer as customizations may be required. Having said that, I know that Ixiasoft has recently made public it’s “Small Business” offering (see the docs outlining it here: http://www.ixiasoft.com/en/products/dita-cms/documentation/small-business-edition-4-2/planning-dita-cms-deployment-small-business-edition1/dita-cms-architecture-and-components/dita-cms-architecture/), which is aimed more at SMBs.

I very recently did an update of this research and while I am not currently at liberty to discuss the results in full (it was a sponsored study), the results are very similar to what you see here, with the chief difference being that I have more information on which firms are using which CCMSes. I can find very few examples of firms who are actively using CCMSes at the low end of the market, and have found many cases where firms have clearly “traded up” (or “sideways”) from one CCMS to another, likely because of limitations or sunsetting of the original CCMS. The CCMS market continues to evolve, but much of what I originally wrote a couple of years ago in this blog post still seems to hold true.

Cheers!

Here’s a link to DITAtoo, if you want to add that.

http://intuillion.com/

That’s a link to the company that makes it, not the product itself. The link I use in the article (http://ditatoo.com/) links directly to the product page, and still works. Is this one more current?

Sorry, I was just looking at the bulleted list and saw it wasn’t linked. Actually, I was fiddling with these links because my workplace blocks DITAToo–but not Intuillion. So I wouldn’t be able to tell you if one is more current than the other.

Thanks for the article!